Relocating Your Business

Love what we have to offer? We at the Port Authority would be happy to assist you in placing your business in the area. Our team is dedicated to finding you the right site or building, aligning incentives and financing options, tailoring your workforce needs, and brokering conversations that help you drive growth in your new locale. If you want to learn more about what the Port Authority can do to assist you in your relocation, please fill out the Contact Form or call 740.760.0158 for more details.

If you would like more information on programming and incentives, click on the links below for offering details.

Business Incubation and Co-Working Spaces

Jobs Ohio and other statewide Incentives

- JobsOhio Site Revitalization Program

- Ohio Roadwork Development Fund

- JobsOhio Workforce Grant

- Ohio Job Creation Tax Credit

- Tax Abatement Programs

- Ohio Opportunity Zone Program

- Ohio Enterprise Zone Program

Local Incentive Offerings

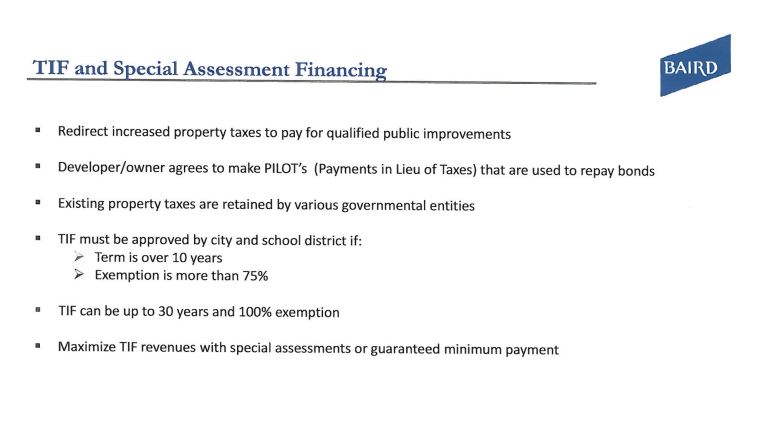

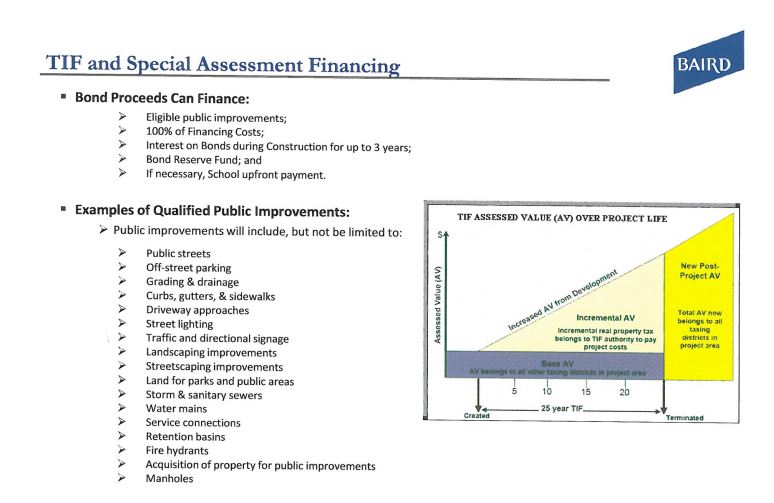

Washington County and local school districts and Joint Vocational Schools are accepting of various Tax Increment Financing structures and are amenable to Tax Abatement Programs with Payment In Lieu of Taxation agreements.

Each case will be applied for and judged independently.

Supplemental: Ohio – West Virginia_ Taxes Comparison

City of Marietta Community Reinvestment Area Program

Currently, only properties in the Marietta City Business District (C-4 zone) can qualify for an exemption.